Swachh Bharat Abhiyaan, Prime Minister Narendra Modi’s ambitious project to make India a clean country, aims to teach citizens to reduce and even clean their own waste. But first a matter of real urgency needs to be sorted out: India needs to increase landfill area, even as it looks into overhauling its municipal solid waste management system.

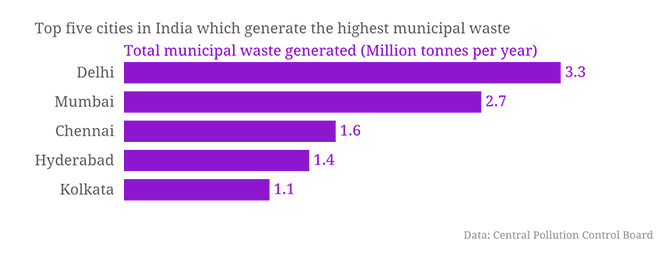

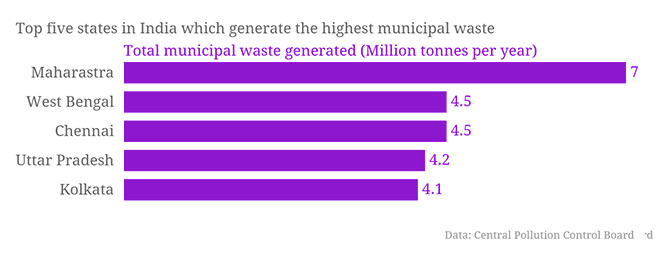

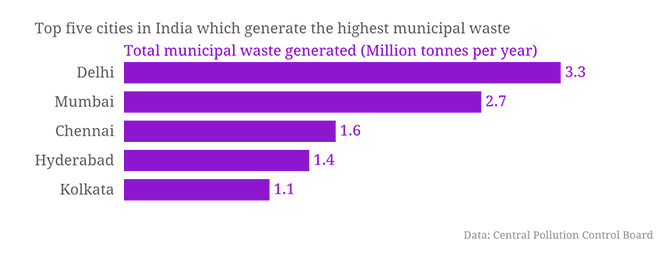

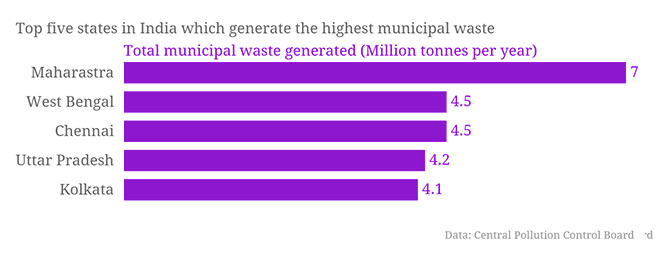

India generates about 60 million tonnes of trash every year. Ten million tonnes of garbage is generated in just the metropolitan cities: Delhi, Mumbai, Chennai, Hyderabad, Bangalore and Kolkata. The landfills of most of these cities are already overflowing, with no space to accommodate fresh garbage waste.

According to an expert at the Centre of Science and Environment, instead of constructing new landfill sites, the government should be looking into innovative methods to dispose and recycle its waste. The reason why most landfill sites are over-flowing is because the current waste disposal system is flawed.

“The segregation of biodegradable waste from non-biodegradable waste is not done properly,” said Sunita Narain, director of the Centre of Science and Environment. “The municipal authorities should develop a model to ensure the same.”

In addition, at many landfill sites due to the lack of an effective waste recycling system, solid waste is burned without segregating bio-degradable waste from non-biodegradable waste. This leads to the release of toxic gases that cause acute respiratory diseases and environmental degradation.

More landfill sites

Delhi generates approximately 9,000 metric tonnes of solid waste, which is dumped into four landfill sites. Three of the four landfills in Delhi should have stopped being used between 2005 and 2009. Experts say this is not unusual.

In addition, Delhi’s four landfill sites extend over 164 acres, when the current requirement is nearly four times the available area – 650 acres, according to a 2011 report by the Central Pollution Control Board.

“Even if people learn to dump their garbage at the dhalaos [a small garbage dump typically servicing a few streets of a neighbourhood], how will that help if the dhalaos can’t be emptied, since there are barely any space left in landfills,” Narain asked.

Mumbai generates 6,500 metric tonnes of garbage daily, including 2,500 metric tonnes of silt and debris, besides 25 tonnes of bio-medical waste. A significant amount of the waste (4,500 metric tonnes per day) is dumped at the Deonar dumping ground, located in the eastern suburb of the city.

According to Brihanmumbai Municipal Corporation, the Deonar landfill site will expire by the end of 2016. The landfills in Gorai and Chincholi Bunder have already been shut down due to over-use. The Mulund dumping ground has also been overused and the BMC is contemplating shutting this down as well.

In addition, Mumbai also generates 21 lakh tonnes of industrial waste per year, which is half of the national total, according to the Central Pollution Control Board report. Industrial waste is also dumped into the landfills.

Segregation and recycling of waste

Segregation of waste should occur at the colony or neighbourhood level, when the waste is collected. The dhaloas in the metropolitan cities are always overflowing due to lack of segregation. Recyclable waste like construction and demolition waste, organic waste like household garbage, toxic waste like medical waste, are all mixed together.

“Most of the construction and demolition waste can be recycled,” said Ravi Agarwal, director at Toxics Link. “It shouldn’t reach the landfills to begin with. The municipal bodies should learn from countries abroad that recycle most of their C&D waste.”

“We cannot quantify the amount of organic waste reaching us because it’s all mixed,” a South Delhi Municipal Corporation official said. Once mixed, it is impossible to segregate recyclable waste from organic waste, according to Agarwal.

Environmental hazards

Nearly 20% of methane gas emissions in India is caused by landfills. Travel past one of these landfills and you are bound to see great spirals of smoke climbing the horizon, as the trash catches fire due to the heat generated by the decomposition of waste.

Most of these landfills have not been built according to accepted specifications. “Due to the decomposition of inorganic waste, the ground water is contaminated,” Agarwal said. “There is also the problem of leachate [when rainfall percolates through the waste in a landfill] because most of these dumping grounds are not scientific landfills.”

A study by scientists at the School of Environmental Sciences in Jawaharlal Nehru University found high levels of nickel, zinc, arsenic, lead, chromium and other metals in the solid waste at landfills in metro cities, especially in Delhi.

“Before cleaning up the city, the government needs to sort out a concrete waste management system that ensures segregation and recycling,” Narain said. “Process everything that can be processed and dump only the residue or inerts in the landfill.”

The old fossil order is on borrowed time as China and even India join the drive for dramatic cuts in CO2 emissions

The fossil fuel industry has taken a very cavalier bet that China, India and the developing world will continue to block any serious effort to curb greenhouse emissions, and that there is, in any case, no viable alternative to oil, gas or coal for decades to come.

Both assumptions were still credible six years ago when the Copenhagen climate summit ended in acrimony, poisoned by a North-South split over CO2 legacy guilt and the allegedly prohibitive costs of green virtue.

At that point the International Energy Agency (IEA) was still predicting that solar power would struggle to reach 20 gigawatts by now. Few could have foretold that it would in fact explode to 180 gigawatts – over three times Britain’s total power output – as costs plummeted, and that almost half of all new electricity installed in the US in 2013 and 2014 would come from solar.

The old fossil order is on borrowed time as China and even India join the drive for dramatic cuts in CO2 emissions

The fossil fuel industry has taken a very cavalier bet that China, India and the developing world will continue to block any serious effort to curb greenhouse emissions, and that there is, in any case, no viable alternative to oil, gas or coal for decades to come.

Both assumptions were still credible six years ago when the Copenhagen climate summit ended in acrimony, poisoned by a North-South split over CO2 legacy guilt and the allegedly prohibitive costs of green virtue.

At that point the International Energy Agency (IEA) was still predicting that solar power would struggle to reach 20 gigawatts by now. Few could have foretold that it would in fact explode to 180 gigawatts – over three times Britain’s total power output – as costs plummeted, and that almost half of all new electricity installed in the US in 2013 and 2014 would come from solar.

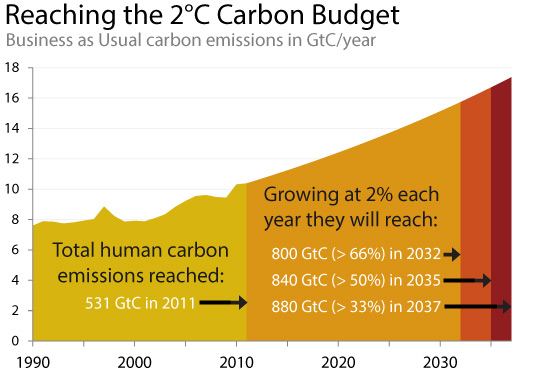

But this is the goal accepted by world leaders. It is solemnly enshrined in international accords, and while it might once have been possible for energy companies to dismiss these utterings as empty pieties, to persist now is to trifle with fate.

“This is a world apart from where we were going into Copenhagen. The centre of gravity has fundamentally and irreversibly shifted,” said Mark Kenber, head of the Climate Group.

China switched sides several years ago, not least because it faces a middle class insurrection that has shaken the Communist Party to its core. An estimated 100m people viewed the anti-pollution video “Under the Dome” in just 24 hours before it was shut down by horrified officials in February.

The IEA says China invested $80bn in renewable energy last year, as much as the US and the EU combined. It is blanketing chunks of the Gobi Desert with solar panels, necessary to absorb the massive surplus production of its own solar companies. The party’s Energy Research Institute has floated the idea of raising the renewable share of electricity to 86pc by 2050.

It is patently obvious that China is not about to sabotage a climate deal. Its submission to the COP21 summit aims for peak greenhouse emissions by 2030, if not before. It plans 200 gigawatts (GW) of wind and 100GW of solar by then, and a reduction in coal use from 2020 onwards. There will be a carbon emissions trading scheme as soon as 2017.

But this is the goal accepted by world leaders. It is solemnly enshrined in international accords, and while it might once have been possible for energy companies to dismiss these utterings as empty pieties, to persist now is to trifle with fate.

“This is a world apart from where we were going into Copenhagen. The centre of gravity has fundamentally and irreversibly shifted,” said Mark Kenber, head of the Climate Group.

China switched sides several years ago, not least because it faces a middle class insurrection that has shaken the Communist Party to its core. An estimated 100m people viewed the anti-pollution video “Under the Dome” in just 24 hours before it was shut down by horrified officials in February.

The IEA says China invested $80bn in renewable energy last year, as much as the US and the EU combined. It is blanketing chunks of the Gobi Desert with solar panels, necessary to absorb the massive surplus production of its own solar companies. The party’s Energy Research Institute has floated the idea of raising the renewable share of electricity to 86pc by 2050.

It is patently obvious that China is not about to sabotage a climate deal. Its submission to the COP21 summit aims for peak greenhouse emissions by 2030, if not before. It plans 200 gigawatts (GW) of wind and 100GW of solar by then, and a reduction in coal use from 2020 onwards. There will be a carbon emissions trading scheme as soon as 2017.

155 countries have submitted plans so far for the COP21 climate summit to be held by the United Nations in Paris this December Photo: Alamy

The text makes it very clear that China considers itself “among those countries that are most severely affected by the adverse impacts of climate change” and is pushing for a far-reaching COP21 deal in its own defence. Going green with a vengeance is one way that China wishes to reposition itself as a global “soft power” force, as will become clear during its presidency of the G20 next year.

The last hold-outs are increasingly lonely as China, the US, Europe, Japan and Mexico all flaunt their good intentions. India has shifted safely into the middle ground, dashing the last hopes of those who thought COP21 would wither on the vine. India invoked “our planet Mother Earth”, Mahatma Gandhi, and the ancient practices of yoga in its poetic submission, pledging to raise renewables to 40pc of power output by 2030 (mostly solar) and to soak up three billion turns of carbon dioxide in new forests.

It plans to cut the energy intensity of GDP by a third from 2005 levels, no easy task for an economy on the cusp of an industrial surge. India’s green think-tank TERI called it an “unprecedented” shift.

155 countries have submitted plans so far for the COP21 climate summit to be held by the United Nations in Paris this December Photo: Alamy

The text makes it very clear that China considers itself “among those countries that are most severely affected by the adverse impacts of climate change” and is pushing for a far-reaching COP21 deal in its own defence. Going green with a vengeance is one way that China wishes to reposition itself as a global “soft power” force, as will become clear during its presidency of the G20 next year.

The last hold-outs are increasingly lonely as China, the US, Europe, Japan and Mexico all flaunt their good intentions. India has shifted safely into the middle ground, dashing the last hopes of those who thought COP21 would wither on the vine. India invoked “our planet Mother Earth”, Mahatma Gandhi, and the ancient practices of yoga in its poetic submission, pledging to raise renewables to 40pc of power output by 2030 (mostly solar) and to soak up three billion turns of carbon dioxide in new forests.

It plans to cut the energy intensity of GDP by a third from 2005 levels, no easy task for an economy on the cusp of an industrial surge. India’s green think-tank TERI called it an “unprecedented” shift.

The energy industry is still banking on ever-rising demand for its products as if nothing has changed Photo: ALAMY

There is still a North-South haggle over money – erupting in terse words last week in Bonn – but this dispute has become ritualistic, increasingly hollow in a world where China is now a creditor. It revolves around $100bn of annual funds pledged by the rich countries long ago. “It’s peanuts,” said Mrs Figueres.

The sums are trivial set against the $90 trillion of new energy investment that the IEA deems necessary by 2030 just to keep the global juggernaut on the road.

The IEA says the COP21 pledges imply will require $13.5 trillion of energy-saving and low carbon investments alone over the next fifteen years. New emissions will “slow to a crawl” by 2030.

Global energy intensity will rise three times faster than hitherto, and 70pc of all new power added will come from low-carbon sources. Markets will do the job under the right terms and they are already making the switch as they discover a potentially lucrative new home for the world’s glut of excess savings and capital.

A Carbon Tracker forum in the City this week was packed with bankers and fund managers itching to find a way into the biggest investment boom of all time, which is what the Paris accord promises to ignite.

The energy industry is still banking on ever-rising demand for its products as if nothing has changed Photo: ALAMY

There is still a North-South haggle over money – erupting in terse words last week in Bonn – but this dispute has become ritualistic, increasingly hollow in a world where China is now a creditor. It revolves around $100bn of annual funds pledged by the rich countries long ago. “It’s peanuts,” said Mrs Figueres.

The sums are trivial set against the $90 trillion of new energy investment that the IEA deems necessary by 2030 just to keep the global juggernaut on the road.

The IEA says the COP21 pledges imply will require $13.5 trillion of energy-saving and low carbon investments alone over the next fifteen years. New emissions will “slow to a crawl” by 2030.

Global energy intensity will rise three times faster than hitherto, and 70pc of all new power added will come from low-carbon sources. Markets will do the job under the right terms and they are already making the switch as they discover a potentially lucrative new home for the world’s glut of excess savings and capital.

A Carbon Tracker forum in the City this week was packed with bankers and fund managers itching to find a way into the biggest investment boom of all time, which is what the Paris accord promises to ignite.

The COP21 emission targets imply an assault on multiple fronts at once. Fossil subsidies worth $600bn a year – or $5.3 trillion under the International Monetary Fund’s elastic definition – are already sliding fast. They will inevitably fade away.

There will have to be a carbon price, whether a tax or a trading scheme, and it will have to rise over time as the “year zero” of negative CO2 emissions comes closer.

Carbon capture and storage can perhaps save large parts of the fossil industry if it moves in time, which is why the World Coal Association has belatedly become a cheerleader for what was once an outlandish idea of the greens. Shell says a carbon price of $40 would bring CCS into play under current technology – some say $80 – but that in itself would shift the balance of advantage further in favour of renewables just as the cross-over point arrives. In large parts of Africa it already has: it is cheaper and quicker to install micro-grids based on solar power than to bother with power stations.

The old energy order is living on borrowed time. You can, in a sense, compare what is happening to the decline of Britain’s canals in the mid-19th century when railways burst onto the scene and drove down cargo tolls, destroying the business model.

Technology takes no prisoners. Nor does politics. World leaders have repeatedly stated that they would defend the line of a ‘two degree planet’, and now they are taking the concrete steps to do so. Fossil investors have been warned.

The COP21 emission targets imply an assault on multiple fronts at once. Fossil subsidies worth $600bn a year – or $5.3 trillion under the International Monetary Fund’s elastic definition – are already sliding fast. They will inevitably fade away.

There will have to be a carbon price, whether a tax or a trading scheme, and it will have to rise over time as the “year zero” of negative CO2 emissions comes closer.

Carbon capture and storage can perhaps save large parts of the fossil industry if it moves in time, which is why the World Coal Association has belatedly become a cheerleader for what was once an outlandish idea of the greens. Shell says a carbon price of $40 would bring CCS into play under current technology – some say $80 – but that in itself would shift the balance of advantage further in favour of renewables just as the cross-over point arrives. In large parts of Africa it already has: it is cheaper and quicker to install micro-grids based on solar power than to bother with power stations.

The old energy order is living on borrowed time. You can, in a sense, compare what is happening to the decline of Britain’s canals in the mid-19th century when railways burst onto the scene and drove down cargo tolls, destroying the business model.

Technology takes no prisoners. Nor does politics. World leaders have repeatedly stated that they would defend the line of a ‘two degree planet’, and now they are taking the concrete steps to do so. Fossil investors have been warned.  Swachh Bharat Abhiyaan, Prime Minister Narendra Modi’s ambitious project to make India a clean country, aims to teach citizens to reduce and even clean their own waste. But first a matter of real urgency needs to be sorted out: India needs to increase landfill area, even as it looks into overhauling its municipal solid waste management system.

India generates about 60 million tonnes of trash every year. Ten million tonnes of garbage is generated in just the metropolitan cities: Delhi, Mumbai, Chennai, Hyderabad, Bangalore and Kolkata. The landfills of most of these cities are already overflowing, with no space to accommodate fresh garbage waste.

Swachh Bharat Abhiyaan, Prime Minister Narendra Modi’s ambitious project to make India a clean country, aims to teach citizens to reduce and even clean their own waste. But first a matter of real urgency needs to be sorted out: India needs to increase landfill area, even as it looks into overhauling its municipal solid waste management system.

India generates about 60 million tonnes of trash every year. Ten million tonnes of garbage is generated in just the metropolitan cities: Delhi, Mumbai, Chennai, Hyderabad, Bangalore and Kolkata. The landfills of most of these cities are already overflowing, with no space to accommodate fresh garbage waste.

According to an expert at the Centre of Science and Environment, instead of constructing new landfill sites, the government should be looking into innovative methods to dispose and recycle its waste. The reason why most landfill sites are over-flowing is because the current waste disposal system is flawed.

“The segregation of biodegradable waste from non-biodegradable waste is not done properly,” said Sunita Narain, director of the Centre of Science and Environment. “The municipal authorities should develop a model to ensure the same.”

In addition, at many landfill sites due to the lack of an effective waste recycling system, solid waste is burned without segregating bio-degradable waste from non-biodegradable waste. This leads to the release of toxic gases that cause acute respiratory diseases and environmental degradation.

According to an expert at the Centre of Science and Environment, instead of constructing new landfill sites, the government should be looking into innovative methods to dispose and recycle its waste. The reason why most landfill sites are over-flowing is because the current waste disposal system is flawed.

“The segregation of biodegradable waste from non-biodegradable waste is not done properly,” said Sunita Narain, director of the Centre of Science and Environment. “The municipal authorities should develop a model to ensure the same.”

In addition, at many landfill sites due to the lack of an effective waste recycling system, solid waste is burned without segregating bio-degradable waste from non-biodegradable waste. This leads to the release of toxic gases that cause acute respiratory diseases and environmental degradation.